By creckk On 05-09-2025 at 11:54 am

India’s Passenger Vehicle Leaders See Market Share Erode in FY25

Passenger Vehicle Market Share Trends: A Changing Landscape in FY25

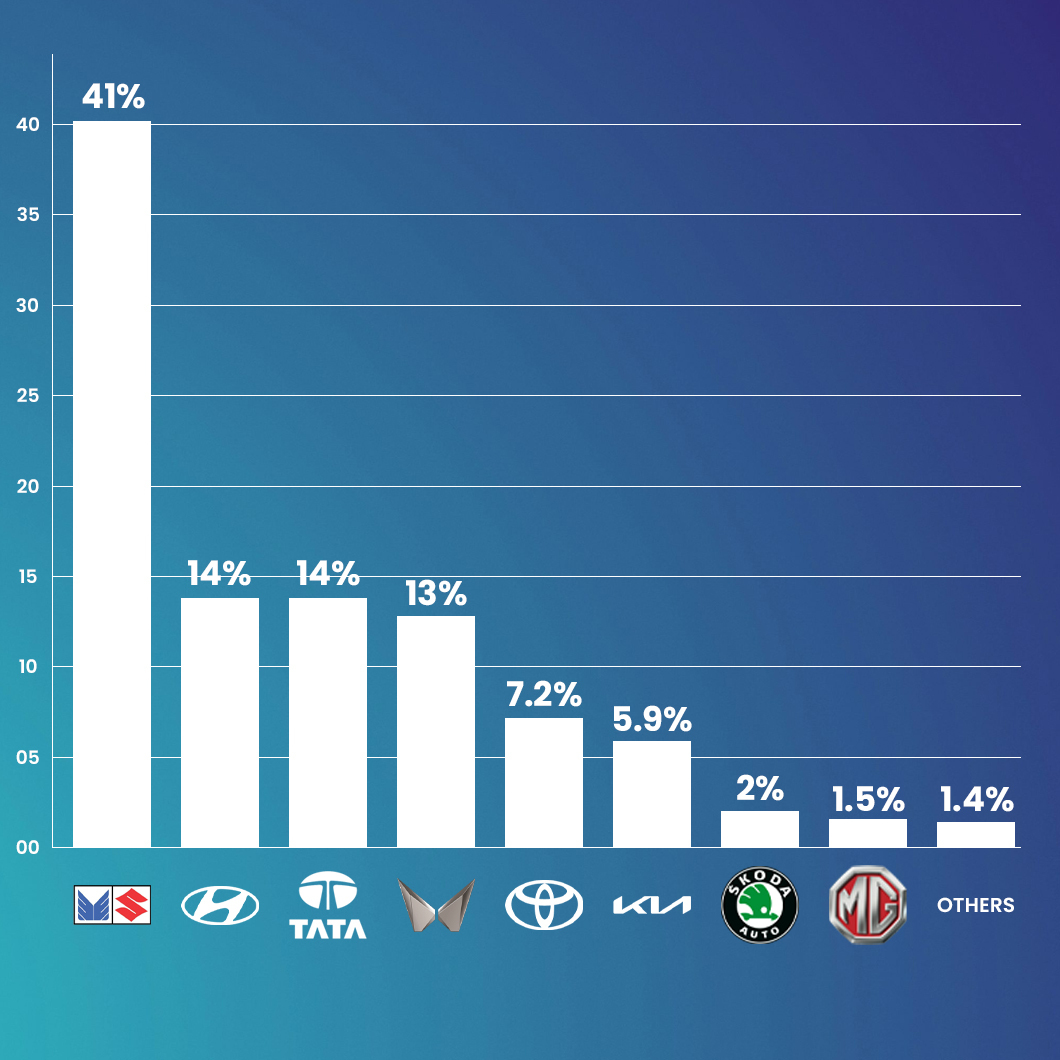

In FY25, India's passenger vehicle market is in the middle of a major shift. The dominance of legacy players like Maruti Suzuki and Hyundai is slowly fading, while new challengers like Tata Motors, Mahindra & Mahindra, Toyota, Kia, and MG are grabbing a larger share of the pie. The transition in consumer preferences, driven by SUVs, EVs, and tech-driven features, is reshaping the entire market. Here's a breakdown of how the market has evolved over the past five years.

Market Share Trends Over Five Years

India's top automakers have seen their market shares shift significantly between FY21 and FY25. The following table provides a snapshot of how each company performed during this period:

Maruti Suzuki, once the undisputed leader of the Indian passenger vehicle market, has seen its share slide from 48% in FY21 to 41% in FY25. This decline reflects the changing consumer preferences as buyers move away from basic hatchbacks and toward more feature-packed SUVs, electric vehicles (EVs), and premium models. While Maruti still leads the market, its once-untouchable position is now under increasing pressure.

Hyundai: Decline of the Solid No. 2

Hyundai, which held a 17% share in FY21, has also seen a downward trend, dropping to 14% in FY25. The brand still appeals to many buyers with its strong designs and reliable features. However, Tata and Mahindra’s growing presence, particularly in the SUV and EV segments, is gradually taking away market share from Hyundai, reducing its influence.

Mahindra & Mahindra (M&M): SUV King Rising

Mahindra’s market share has surged from 6% in FY21 to 13% in FY25, thanks to its successful SUV offerings. Iconic models like the Scorpio-N, XUV700, and Thar have made Mahindra a go-to choice for SUV enthusiasts. The brand has become a serious player in the Indian market, fueled by the growing demand for SUVs. With its steady rise, Mahindra is becoming one of the most formidable forces in the market.

| Automaker | FY25 Market Share | Notable Insights |

|---|---|---|

| Maruti Suzuki | 41% | Lowest since 2012–13; still India’s top automaker but under pressure. |

| Hyundai | 14% | Dropped to decade-low levels; losing ground to Mahindra & Tata. |

| Mahindra & Mahindra | 13% | Big gainer; SUVs (Scorpio-N, Thar, XUV700) pushed it to 2nd largest by retail sales. |

| Tata Motors | 14% | Strong EV lineup + ICE models; steady market hold despite fierce competition. |

| Toyota | 7.2% | Hybrid-focused strategy; success with Innova Hycross, Urban Cruiser Hyryder. |

| Kia | 5.9% | Tech-packed SUVs (Seltos, Sonet) appeal to young urban buyers. |

| MG Motor | 1.4% | Small share but growing; focused on EVs like ZS EV & tech-driven strategy. |

Tata Motors: The EV + Design Edge

Tata Motors has made a remarkable comeback, moving from 8% in FY21 to 14% in FY25. The company has aggressively pushed into the EV space with successful models like the Nexon EV and Tiago EV, while also offering bold internal combustion engine (ICE) vehicles like the Punch and Harrier. Tata's focus on both electric and traditional vehicles has enabled it to maintain a strong market position, showing resilience and flexibility in an evolving industry.

Toyota: The Quiet Performer

Toyota is not aiming for mass-market volume but is carving out a niche with its 7.2% market share in FY25. Known for its focus on reliability and premium features, Toyota has focused on hybrid tech and high-end MPVs/SUVs like the Innova Hycross and Urban Cruiser Hyryder. While Toyota may not lead the market, its loyal customer base and premium offerings have ensured its steady presence in India.

Kia: Feature-Loaded Challenger

Kia’s market share reached 5.9% in FY25. The company has positioned itself as a challenger brand in the SUV market, with models like the Seltos and Sonet standing out due to their feature-rich offerings and stylish designs. Kia has effectively targeted young, urban buyers who seek modern vehicles packed with technology, making it a strong competitor to other brands in the segment.

MG Motor: Small but Noticeable

MG’s market share in FY25 is still relatively small at 1.4%, but the brand is growing slowly but surely. MG has chosen to focus on EVs and tech-forward features, with vehicles like the ZS EV and Hector leading the charge. The brand is betting on electric mobility to drive its future growth, and while it may be small, it’s a company to watch as India moves towards greener transportation.

The Big Picture: From Duopoly to Multi-Player Arena

The Indian passenger vehicle market has undergone a dramatic transformation in recent years. Once dominated by Maruti Suzuki and Hyundai, the market is now a crowded, competitive space with Mahindra, Tata, Toyota, Kia, and MG all playing key roles. Consumers now have more choices than ever, and this fierce competition has led to smarter, more feature-packed cars across the board.

FAQs

Why are Maruti Suzuki and Hyundai losing share?

Both Maruti Suzuki and Hyundai are losing market share because consumers are shifting towards SUVs, electric vehicles, and premium features—segments where Tata, Mahindra, Toyota, and Kia have become more competitive.

Who are the biggest gainers in FY25?

Mahindra and Tata are the biggest gainers in FY25, with Mahindra’s market share rising to 13%, while Tata remains steady at 14%. Toyota and Kia have also gained ground, carving out niche markets.

How is Toyota doing in India?

Toyota’s 7.2% market share in FY25 reflects its strong position in the premium and hybrid segments. By focusing on hybrid technology, reliability, and premium offerings like the Innova Hycross and Urban Cruiser Hyryder, Toyota is securing a loyal customer base.

Is Kia really competing with giants?

Yes, Kia’s 5.9% market share is evidence of its growing influence in the SUV segment. Models like the Seltos and Sonet, packed with advanced features and offering great value for money, have helped Kia carve out a solid position.

What about MG?

MG has a smaller 1.4% market share, but its focus on electric vehicles like the ZS EV, combined with its tech-forward strategy, signals that it’s positioning itself for future growth in India’s rapidly evolving automotive landscape.

Related posts